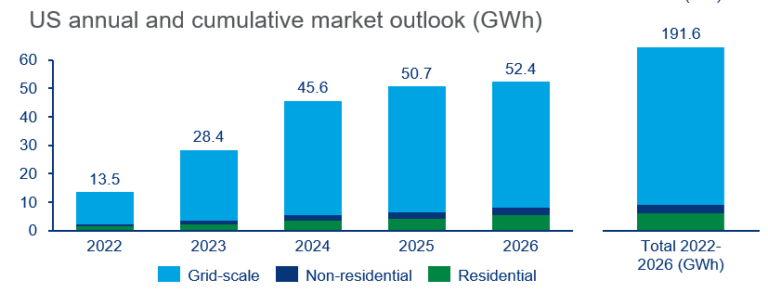

The US market is on course to reach 13.5GWh of energy storage installations during 2022, according to Wood Mackenzie Power & Renewables.

The market research and analysis firm has just issued the Q2 2022 edition of its quarterly US Energy Storage Monitor, produced in partnership with the American Clean Power Association, in which it found that the three-month period saw 3,042.4MWh of storage deployed across the grid-scale, residential and non-residential (commercial, industrial and community) market segments.

In the grid-scale market segment alone, 2,608MWh was installed during the quarter, the highest second quarter figure recorded to date. The Texas market was the single strongest regional contributor to that grid-scale number, with more than 60% of deployments.

This was in spite of various factors that have caused delays to projects around the country in recent months. Back in June, as the firm’s Q1 findings were published, Wood Mackenzie (WoodMac) said that procurement challenges and long interconnection waiting times put project completion dates back by months in many cases.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In Q1, WoodMac said 2,875MWh of storage was deployed across all segments, including 2,339MWh of grid-scale storage – which was also the strongest opening quarter to a year on record.

WoodMac previously said its US deployment forecasts for 2022 had been downgraded by about 30% versus earlier predictions, with one major driver for that being uncertainty around the fate of anti-dumping countervailing duties (AD/CVD) tariffs placed on imported solar modules.

That led solar-plus-storage developers – a significant chunk of the US storage market – to hesitate or delay on procurements. The tariffs are gone for now, since President Joe Biden ordered a two-year pause on them, but the industry continues to “wrestle” with the US’ policy on products associated with forced labour in the Xinjiang region of China, which means some hesitancy is still expected, WoodMac said.

That and other causes of delays such as price spikes for raw materials, components and shipping costs impacted around 1.1GW of large-scale battery storage projects that were expected to come online during Q2 2022. While a significant portion of that number may be cancelled altogether, WoodMac does expect the majority, around 709MW, to still come online during Q3 or Q4.

“Despite impressive growth, the US grid-scale energy storage pipeline continues to face rolling delays into 2023 and beyond,” Wood Mackenzie senior energy storage analyst Vanessa Witte said.

“Supply chain issues, transportation delays and interconnection queue challenges were the main drivers behind delays in the commercial operations date (COD) for many projects.”

Inflation Reduction Act poised to transform an already rapidly-growing market

The firm’s prediction for the full year would represent a big increase on 2021 figures, when about 10.5GWh was deployed in total including 9.2GWh of grid-scale energy storage.

Regular readers of this site will be aware that the recent passing of the Inflation Reduction Act (IRA) legislation in the US is projected to add a considerable upside to an already rapidly growing industry. Chief among its impacts will be the eligibility of standalone energy storage for investment tax credit (ITC) incentives from the end of this year, which many have commented could supercharge the sector by reducing capital expenditure costs on projects by around 30%.

That and other clean energy-friendly measures in the IRA will spur the US on to become a 52.4GWh annual market in 2026 and see cumulative deployment of 191.6GWh of energy storage in the 2022 to 2026 timeframe, according to the firm’s predictions.

Chloe Holden, another Wood Mackenzie analyst who authored the new report, noted that the IRA’s extension of the existing ITC for solar PV would likely have a positive impact on the residential solar-plus-storage market.

The residential sector also had a strong Q2, with 154MW/375MWh of installations, the strongest quarter to date in terms of megawatt-hours.

“The solar ITC extension is good news for the residential storage industry, preventing a drop in residential solar-plus-storage installations that would have otherwise arrived in 2024,” Holden said.

“The standalone storage ITC will also boost storage retrofits on homes with existing solar.”

The non-residential segment struggles to record major growth however, with deployments focused largely in states with supportive policies, like California, New York and Massachusetts. Just 26.3MW/59.4MWh of non-residential deployments figured in WoodMac’s report.